I had a conversation with a Kalenjin friend about investing. His views on investing contrasts with mine so much. Before I break down the facts and myths, I wish to tell you a short story.

A story about a young bride

A young bride was seen by her husband breaking the legs of a chicken before placing it in the oven to grill instead of placing it whole. Her husband inquired the reason for that and she said its because she saw her mother breaking the legs. When they went to visit her parents, she asked her mother why she used to break the legs and her mother said it’s because she saw her mother do it. They decided to call her grandmother who said the reason for breaking the legs is because her oven was small. So the young bride in spite of having a big oven kept practising the habits of her grandmother who had a small oven.

Lessons from the story

The story about this bride is typical of how we have all been brought up being told that certain people or places are a certain way. I remember being told that people from a certain tribe eat people. I was later to learn that one of my family’s closest friends is from that tribe. It was not fair for someone to lie to me that way.

Investing like politics

When it comes to investing and politics, most of us will revert to the eating people way of thinking and end up investing in a place where the returns are too low or non-existent because you invested out of fear and superstition.

History on how the Kikuyu, Merus and the Kalenjin invested

The history about how the Kikuyu, Merus and the Kalenjin invest / invested can be traced back to the 1950’s when Kenyans were allowed to form cooperative movements.

The Kikuyus and Merus came to Nairobi and with the money they made from the sale of tea leaves and coffee, they bought properties in Nairobi (Imenti house, Kangema house etc), Ruai, Pipeline, Ruiru etc.

In 1963 when Kenya gained its independence and Nairobi became the Capital city, they enjoyed great returns, and they still do to date. This informed rural-urban migration which left the Kikuyu rural towns to degrade into small villages. Most of these village towns do not have any meaningful developments to date.

The Meru’s have more money (food, coffee, tea and Miraa) and are able to invest in both Nairobi and Meru.

The Kalenjins had bigger parcels of land and they also formed co-operatives. They mostly preferred to invest in their home towns as they still do to date. Why is that?

The Contrast

The Kikuyu do not have well developed rural towns. In fact, most Kikuyus will tell you they mostly frequent their rural homes to attend funerals and come back to Nairobi the same day.

The Meru’s and Kalenjins are not so. They make bi-weekly or monthly trips back home and invest there heavily. Their towns are vibrant and their economy is growing.

Invest in the year 2020

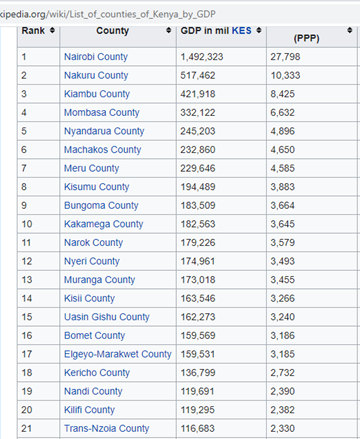

I would like to invite you to think about how to invest in the year 2020. Let’s measure the size of the various counties using the GDP.

According to data on counties by GDP provided by the Kenya National Bureau of Statistics in 2017 what is the size of your county’s economy? I am surprised that Nyandarua county is top 5 and Narok is number 11. Which county has surprised you?

If your preferred investment destination is not on the top 10 list, I would like to invite you to reconsider your investment strategy. Could it be that your investment is not bringing you or will not bring you any meaningful returns?

I appreciate your feedback. Please reach me on 0723477035 or email info@kariukiwaweru.com

Valuer Kariùki, MRICS

Registered & Practicing Valuer

Chartered Valuation Surveyor.