There are two essential parts to achieving affordable housing in Kenya: building decent, low-cost homes, and developing a housing finance market that enables low-income earners to buy those homes. For, without finance, almost no home price is low enough to be affordable on an average salary. For this reason, Kenya’s mortgage market has been growing. Housing loans have risen more than tenfold since...

In the papers

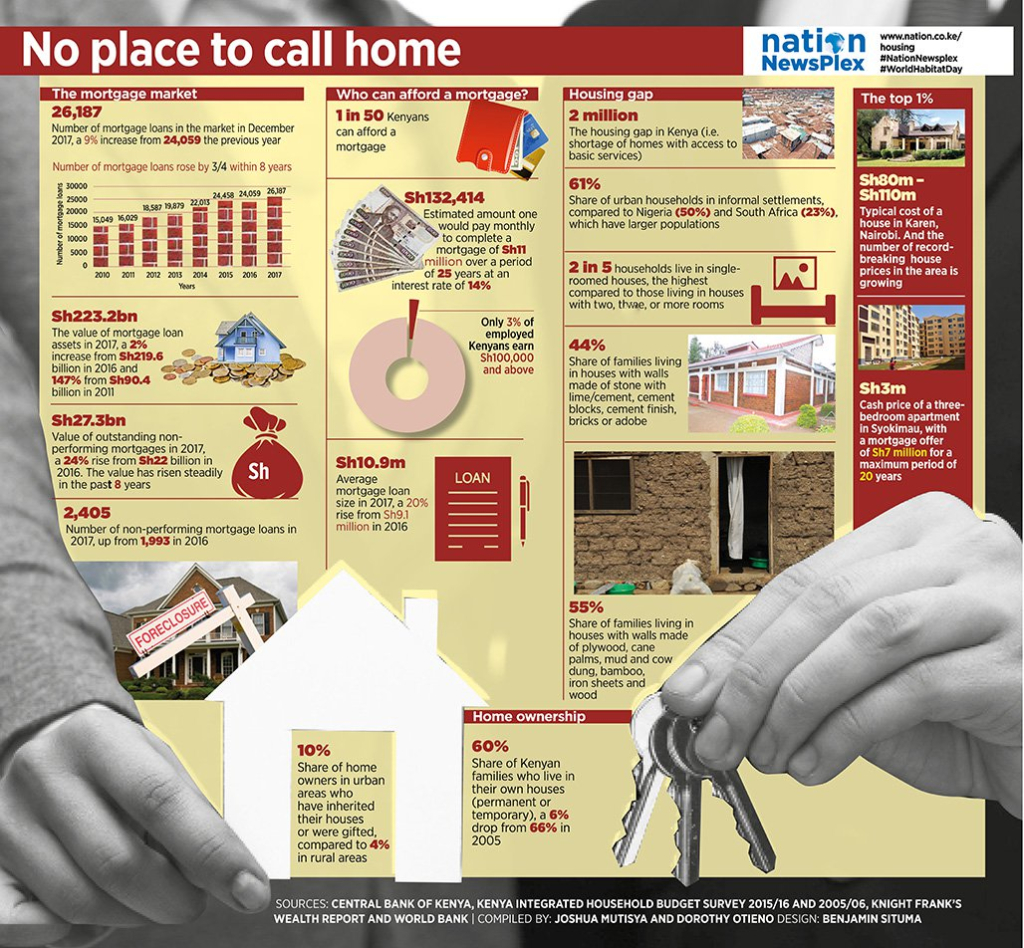

What is the size of the mortgage market in Kenya? There were 26,187 mortgages in the market in 2017, a nine percent rise from 24,059 in 2016. The number of mortgage loans has been on the rise over the years. How many Kenyans can afford a mortgage? A 2011 World Bank report estimated that only 11 percent of the urban population can afford a mortgage. Households need to have a comfortable income to...

A failed vision By RICHARD MAROSI | Veracruz, Mexico NOV. 26, 2017 Sixteen years ago, Mexico embarked on a monumental campaign to elevate living standards for its working-class masses. The government teamed with private developers to launch the largest residential construction boom in Latin American history. Global investors — the World Bank, big foundations, Wall Street firms — poured billions of...

By LUKORITO JONESDaily Nation January 24 2018 While the real estate scene across the country might appear promising, “There are several locations where its bubble has either burst or is just about to burst,” warns Valuer Kariuki, a valuer and real estate adviser. The author of The ABC of Real Estate Investment in Kenya, who has more than 10 years’ experience, says investing in real estate is...